中国财政部近日重申,于三年前发布的《关于实施境外旅客购物离境退税政策的公告》依然有效。即境外旅客在政策实施地区所购买的商品,可按规定申请增值税退税,退税率为11%起。

换句话说,持加拿大护照的华人在中国的退税商店购买的东西可退还增值税……这可真能省下不少钱呢!

免税店vs退税店

从字面上简单理解,免税就是买商品时不付税费,而退税则是买完商品之后再办理退税。

但是,此税非彼税。

免税,免的是进口关税(Duty Free),税率集中在20%~100%。而退税,退的则是增值税和消费税(Tax free),税率集中在5%~20%。

一般在店门前都会有明显的Duty Free或者是Tax Free的标志,进门前一定要注意看哟!

退税人群

在中国境内连续居住不超过183天的外国人(非中国大陆护照)和港澳台同胞,入境时间以护照上进入中国的日期为准。

持有外国永久居留权(比如加拿大枫叶卡)或者签证的人,暂时还享受不到……

退税要求

同一境外旅客、在同一日、在同一退税商店所购退税商品金额达到500元人民币或以上且:

• 退税商品尚未启用或消费;

• 离境日距所购退税商品购买日不超过90天;

• 所购退税商品由境外旅客本人随身携带或随行托运出境。

退税商品

境外旅客本人在退税商店购买且符合上述退税条件的个人物品,但不包括:

• 金、银和其他稀有金属及金银和金属制品;

• 贵重天然或人文古董;

• 食品,医药,药品;

• 其他法律明文规定严禁出口的商品。

如果不确定所购物品是否否能退税,最好在购买前和商家进行确认。

如何退税

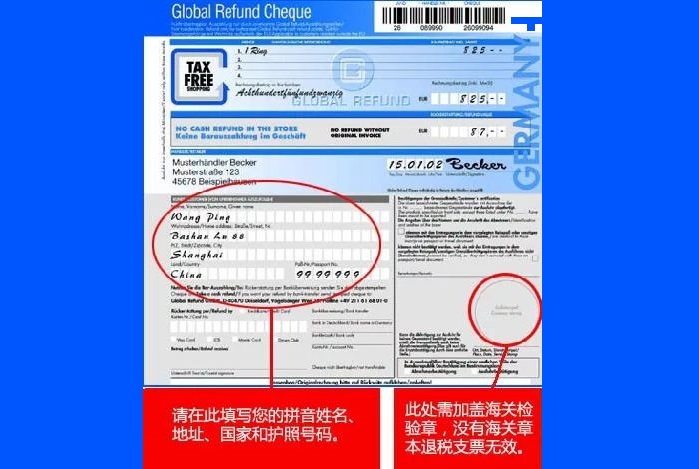

1. 境外旅客在退税商店购买退税物品后,记得向退税商店索取境外旅客购物离境退税申请单和销售发票。

2. 境外旅客在离境口岸离境时,应当主动把退税物品、境外旅客购物离境退税申请单和退税物品销售发票向海关申报并接受海关监管。

3. 在海关验核无误后,在境外旅客购物离境退税申请单上签章。

4. 境外旅客凭护照等本人有效身份证件、海关验核签章的境外旅客购物离境退税申请单、退税物品销售发票向退税代理机构申请办理增值税退税。

退税点

环球蓝联在北京、广州、上海等国际机场内均设有退税点。江湖传言,他们的退税率最高能给到16%哟……

环球蓝联的具体退税点及营业时间等详情,请至其官网:

http://www.globalblue.cn/tax-free-shopping/china/

发表回复